Editor’s note

On June 20, the People’s Bank of China (PBC) and Hong Kong Monetary Authority (HKMA) jointly announced that the cross-boundary Payment Connect between the Chinese mainland and Hong Kong will be officially launched on June 22. This initiative will provide residents and enterprises in both places with more efficient, convenient, and secure cross-boundary payment services, further facilitating economic, trade and personnel exchanges between the two places. Moreover, the launch of Payment Connect will create new driving forces for financial, trade, and tourism cooperation between Beijing and Hong Kong. So, what is cross-boundary Payment Connect? What advantages does it offer? Let’s take a closer look.

What is cross-boundary Payment Connect?

With the launch of the cross-boundary Payment Connect, residents in both regions can make cross-boundary and inter-bank remittances through mobile or online banking channels by simply entering the recipient’s mobile number or account details anytime, anywhere. Funds are transferred in real time, with instant currency exchange and settlement between HKD and RMB. In addition, it enables participating institutions to provide convenient and socially beneficial financial services, such as paying tuition fees and medical expenses, or for the distribution of salaries and subsidies.

Compared to traditional cross-boundary remittances, convenience is the defining feature of Payment Connect. With its launch, residents of the two places can now make cross-boundary remittances by simply entering the recipient’s mobile number or account details.

Fan Yaosheng, General Manager of Clearing Department, Bank of China (BOC), stated, “Through the latest version of the mobile banking application, customers can make remittances via Payment Connect at the relevant section. They can also transfer money using the recipient’s mobile number without entering additional account details, which greatly streamlines personal remittance service.”

While traditional cross-boundary remittances require long settlement periods, Payment Connect enables customers to make inter-bank real-time transfers via online or mobile banks anytime, anywhere.

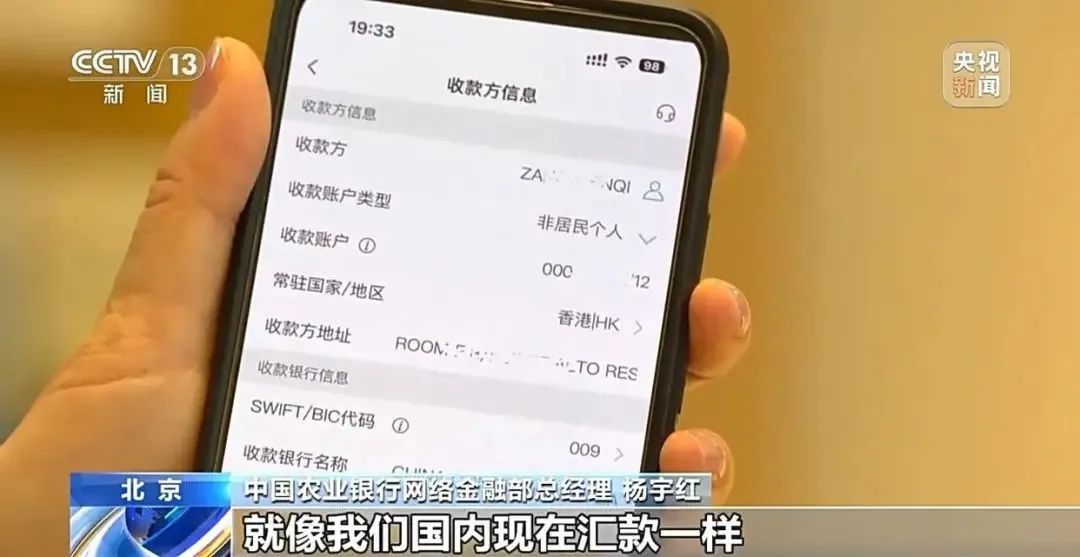

Yang Yuhong, General Manager of Internet Banking Department, Agricultural Bank of China (ABC), stated, “Here is our cross-boundary payment interface. Like transfers within the mainland, all transactions here are processed through PBC’s Payment Connect system, ensuring real-time settlement.”

Moreover, since its launch, the cost of cross-boundary remittance has been significantly reduced.

Chen Zhaoxu, General Manager of Personal Banking Department, Industrial and Commercial Bank of China (ICBC),stated, “Traditional cross-boundary payment system involves more procedures and institutions for routing and processing the transaction, which inevitably increases cost. Now, the direct connection between Chinese mainland’s Internet Banking Payment System (IBPS) and Hong Kong’s Faster Payment System (FPS) has eliminated these intermediate layers, thus significantly reducing costs.”

Economic and trade activities and personnel exchanges between the mainland and Hong Kong are boosted

Journalists learned that the remittance service of Payment Connect has paved the way for transferring RMB between the mainland and Hong Kong, better satisfying residents’ demand for personal fund transfers and propelling the economic integration within the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

With the development of GBA, the economic ties of people in the two places have become increasingly intertwined. As there is a growing demand for cross-boundary education, tourism, and employment, the cross-boundary Payment Connect provides residents in GBA with a secure and convenient payment option.

Chan Man, Deputy Chief Executive, Bank of China (Hong Kong),stated, “The real-time settlement between HKD and RMB has effectively promoted the lives and businesses of GBA residents and enterprises, laying a solid foundation for the integrated development of GBA’s livelihood economy.”

Convenient services such as paying cross-boundary tuition fees are available

Following the launch of the cross-boundary Payment Connect, which banks’ customers can directly transfer funds to Hong Kong accounts? Additionally, what transaction scenarios does the system support for payments between the mainland and Hong Kong?

According to PBC, featuring small-value transactions and convenience, Payment Connect enables participating institutions to provide the people of the two places with cross-boundary remittance services under current accounts. Individuals are exempt from submitting business background information when using this convenient service.

With the cross-boundary Payment Connect, mainland residents holding resident identity cards, military identity cards, or armed police identity cards can transfer funds from mainland participating bank accounts to Hong Kong participating institution accounts; Hong Kong residents holding Hong Kong identity cards can transfer funds from Hong Kong participating institution accounts to mainland participating bank accounts.

Chen Zhaoxu, General Manager of Personal Banking Department, ICBC, stated, “Mainland residents can transfer funds to Hong Kong accounts via the cross-boundary Payment Connect under the section of cross-boundary remittance in the ICBC mobile banking application, with the option to receive funds either in RMB or HKD. Hong Kong residents can transfer funds through the mobile banking application of ICBC (Asia), a branch of ICBC in Hong Kong.”

In addition, it enables participating institutions to provide convenient and socially beneficial financial services, such as paying tuition fees and medical expenses, or for the distribution of salaries and subsidies.

Yang Yuhong, General Manager of Internet Finance Department, ABC,stated, “Since its launch, the service has catered to business scenarios benefiting the livelihood of the people in both places such as tuition fees payment and the distribution of salaries. Leveraging this enhanced financial connectivity, it will deliver more convenient cross-boundary financial services to the people of the two places through continuous innovation.”